Is Your Debt Ruining Your Life? Here Is What You Can Do

Debt can become overwhelming to the point that it can begin crushing your life. You could begin to develop the impression that you are drowning in debt and wonder whether there is a way out of the problem you are dealing with. Fortunately, there is a way out of debt which is easily available to you if you are prepared to challenge the problem head-on.

The path to financial freedom is challenging and is definitely not easy. It will take plenty of discipline on your part to pay down debt, curtail your expenditure and most importantly begin learning to save. You will not have the option of trying these factors one at a time because it will take a concerted effort from you to stop your debt ruining your life. What can you do to stop debt ruining your life?

Evaluate your finances

The most important thing you should be doing is getting a clear understanding of your finances. How much debt are you dealing with presently and what is your debt to income ratio?

The most important thing you should be doing is getting a clear understanding of your finances. How much debt are you dealing with presently and what is your debt to income ratio?

Getting an understanding of your financial status will help you to determine whether things can be rectified or you need to contact a bankruptcy attorney if matters have gotten out of control.

What’s your affordability

Understanding your money is going is also essential because it is the best way to cut back on expenses. If you need to begin trimming your expenses you should be considering the items that are not adding value to your life. Services like satellite television, and a smartphone or not essential commodities of life and giving them up for some days may make it seem that you are living life without any luxuries but it will make it possible for you to save up to $250 or more a month. You can use this money to pay down your debt.

Create a payoff cycle

Financial experts have recommended that it is always beneficial paying off debts which have the highest interest rates first while some have mentioned that the accounts with the largest balance should be paid before the others. We recommend paying off the accounts with the smallest balances because it will seem as a victory and can motivate you as you begin noticing fewer accounts that need to be paid.

Financial experts have recommended that it is always beneficial paying off debts which have the highest interest rates first while some have mentioned that the accounts with the largest balance should be paid before the others. We recommend paying off the accounts with the smallest balances because it will seem as a victory and can motivate you as you begin noticing fewer accounts that need to be paid.

After you have paid off one small account use the money from that account to clear another small account. Over a period of time, it will become possible for you to pay off all your debt if you decide to use this method. Keep a close watch on your credit card statements because you will be able to see the difference in the speed at which it was possible for you to become debt free. If you can make more than the minimum payments every month the speed will increase significantly and leave you in a debt-free situation within a short while.

Begin saving money

People who are caught in a debt situation often stop saving money which is a habit they should never be considering. Saving $25 a month may not seem like a huge amount but will save $600 at the end of the year and the money in the savings account can be used as a backup whenever you come across any emergencies that would normally have been placed on your credit card.

If all methods fail and your debt situation is going out of control causing you to miss mortgage payments by several months you have the option of contacting a bankruptcy attorney. You must, however, remember that bankruptcy laws vary by state and therefore you may be required to pay a certain percentage of your debt back to your creditors. You can use these tips for the assistance you need to get started with your new life to ensure debt ruining your life is a thing of the past.

More in Mind & Body

-

`

Does the Public Still Love Harry after He Left the Royal Family? Here’s the Shocking Truth

Against all odds – this phrase may well describe the story of Prince Harry and Meghan Markle, who, from the very...

April 23, 2020 -

`

Prince Charles Has a New Plan to Prevent More Royal Drama After Megxit, But Will It Work?

The British royal family definitely saw better days before it was struck by controversies that have been shaking up the monarchy since 2019. With...

April 23, 2020 -

`

4 Key Nutrients Your Body Needs for Optimum Performance

Are you familiar with the idiom You are what you eat? That means if you consume the right nutrients, then you’re...

April 23, 2020 -

`

How to Build Your Emotional Resilience During a Time of Chaos

Perhaps for all of us, this new setup brought about by the pandemic is too much to take in. We’re...

April 23, 2020 -

`

Cody Simpson and Miley Cyrus’ Relationship Took a Serious Turn, Fans Are Convinced It Could Only Mean One Thing

There’s something so attractive in men who aren’t afraid to admit that they wouldn’t be a great person if it...

April 23, 2020 -

`

Meghan Markle Has Been Hiding This Secret Relationship from Everyone

The British media has painted a bad image of Meghan Markle, who found it hard to fit in with the...

April 23, 2020 -

`

Prince Harry Under Fire Once Again for a Very Serious Statement

Things seem to be getting worse for the Sussexes, who failed to secure the approval of the British audience since they...

April 23, 2020 -

`

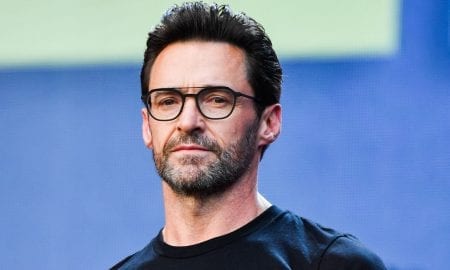

Hugh Jackman Was Offered a Role in Cats But He Turned It Down for a Surprising Reason

It has been years since we last saw Wolverine’s claws on the big screen – of course, with Hugh Jackman...

April 22, 2020 -

`

NFL Superstar Tom Brady Admits His Marriage with Gisele Bundchen Almost Ended Because of Something He Did

Tom Brady and Gisele Bundchen make one of the most gorgeous couples in the world, making most of us turn green...

April 22, 2020

You must be logged in to post a comment Login